michigan unemployment income tax refund

The deadline for Michigan 2021 state income tax returns is also April 18. Please allow 6 weeks to process your refund if you passed the quiz.

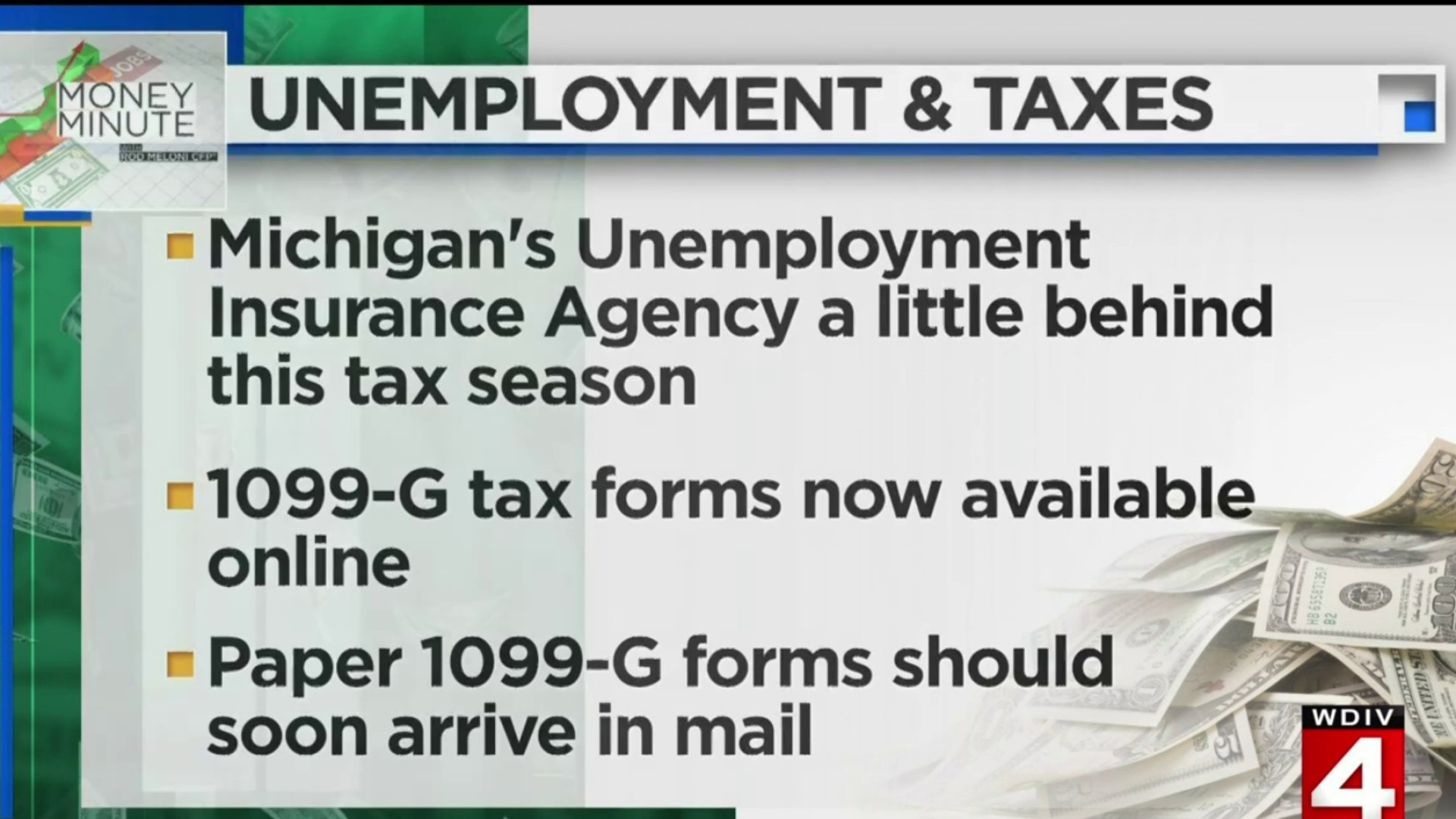

Money Minute Tax Forms Available For Michigan Unemployment Claimants

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information.

. The deadline for Michigan 2021 state income tax returns is also April 18. Michigan unemployment 2021 tax form coming even as benefit waivers linger. If you use Account Services select My Return Status once you have logged in.

I e-filed my Michigan Individual Income Tax Return MI-1040 without claiming the federal unemployment exclusion. Please allow the appropriate time to pass before checking your refund status. When you create a MILogin account you are only required to answer the verification questions one time for each tax year.

If you are unable to access a quiz or did not pass please send in the documents requested from your letter. Adjusted Gross Income AGI or Total Household. Unemployment is a line on your Form 1040 under Schedule 1 Part 1 Additional Income.

The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within. Taxpayers who have filed are on average receiving larger refunds according to the IRS. Michigans state income tax is 425.

You pay tax in your home state only. Notice of Hold on Income Tax Refund or Credit. These taxpayers should file an amended Michigan income tax return to claim that refund.

Some states also tax unemployment benefits while others dont. June 1 2019 236 PM No. Federal tax rates are much higher between 10.

That means the average refund for one week of unemployment from last spring and summer would be roughly 40. Michigan taxpayers who collected unemployment benefits and have not yet filed a state income tax return can file their returns as soon as they are able according to the Michigan Department of Treasury. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. To check the status of your refund use. Rather the federal adjustment will result in a lower Adjusted Gross Income for many federal taxpayers.

This notice was sent because your refund is being held for a State of Michigan debt. Interest on any refund will begin to accrue 45 days after the amended return is received or the date the return is due whichever is later. You may check the status of your refund using self-service.

The Michigan Department of Treasurys Taxpayer Advocate provided our team with the following update. Account Services or Guest Services. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings.

Either you or your spouse is liable for a debt. Parents need to file an income tax return even if theyve never done so before or dont owe any taxes. There is no state-level deduction for the unemployment compensation relief provided by the American Rescue Plan Act of 2021.

Shutterstock Michigan unemployment officials say 12 million residents about. Michigan has a flat income tax rate of 425. Refunds are running about 3226.

Unemployment compensation is generally included in adjusted gross AGI income under the IRC. The federal American Rescue Plan Act was signed into law on March 11 2021. Do not enter unemployment income as a W-2.

In the latest batch of refunds announced in November however the average was 1189. Therefore unemployment compensation is also included in Michigan taxable income. Where do you enter unemployment income on a tax return.

The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits. The states unemployment agency is still trying to determine how many claims paid out improperly during the pandemic will have to be recouped putting workers in a tough spot during tax season. The state UIA said Monday that 1099-G forms now will be sent.

Say Thanks by clicking the thumb icon in a post. If I qualify for a refund on my amended MI-1040 will I receive interest. Thats the case in all but a handful of states Delaware Iowa Louisiana Maine Massachusetts and Virginia that set different deadlines.

March 24 2021. His clients are basically averaging around 430 in extra state refund money after being able to reduce their taxable income by 10200. As long as you meet the qualifications like making under 150000 youll be refunded all unemployment tax paid in 2020 if you received less than 10200 in.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. On 10200 in jobless benefits were talking about 1020 in federal taxes that would have been withheld. Complete sign and submit the enclosed Income Allocation for Non Obligated Spouse Form 743 to determine how much of the refund can be applied to the debt.

Effect of the American Rescue Plan Act on the taxation of unemployment compensation. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. Allow 6 weeks before checking for information.

Michigan residents now are looking at an extra long delay in receiving key tax paperwork from the state Unemployment Insurance Agency. There are two options to access your account information. Allow up to 12 weeks for your refund to be processed.

Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund. If you use tax software it will usually ask you if you received unemployment during the year. These taxpayers should file an amended Michigan income tax return to claim that refund.

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Unemployment Benefits Another Batch Of Corrections This Year Marca

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Form Mi 1040 2011 Michigan Individual Income Tax Return

Inside Michigan S Faulty Unemployment System That Hit Thousands With Fraud Michigan The Guardian

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Money Minute Tax Forms Available For Michigan Unemployment Claimants

How To Upload Your Id Verification Documents In Miwam Youtube

Tax Forms Now Available For Michigan Unemployment Benefits Weyi

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Michigan Announces Unemployment Insurance Tax Forms For 2021 Are Available Online Ballotpedia News

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Michigan Families Need Unemployment Benefits And A Functional System